There’s a saying that “hindsight is 20/20” and the older one gets, the more often that phrase seems to be used! A young person doesn’t always have the information – or knowledge- to make the best financial decisions and, when one is young, it’s difficult to imagine that financial decisions currently being made can have long-term impacts. So, we polled some HTG team members and asked them: “What financial mistake did you make in your 20s?” And more importantly, “How would you advise your 20-something self not to make the same mistake?”

Here are a few of their stories.

What financial mistake did you make in your 20s?

“I had an internship in college, and the professionals I worked for were very impressed with the dominance of a particular stock. So, when I had some extra money, I bought that stock since it seemed like a great company. But even stocks of great companies can go down. I later learned that it is important to understand if you are buying in at an attractive price. Buying overvalued stock, even in a great company, will lead to a bad investment.”

How would you advise your 20-something self not to make the same mistake?

It’s important to not get caught up in “the next big stock tip” and avoid the trap of trying to time the market. I would do my own due diligence before investing and understand that concentration risk can be dangerous. While the company I was investing in was legitimate, it’s also important to be aware of the prevalence of investment scams that are too good to be true.

Now, a safer way is to invest in stock markets rather than individual stocks. By choosing mutual funds and ETFs, which are a basket of stocks, you are diversifying your risk while owning lots of companies.

Before investing in anything new, there are five questions you should ask yourself:

- Can I explain to someone how the individual or company makes money, and am I sure they do what they say they do?

- Why are others not seeing this exceptional investment opportunity that I see?

- What will be the catalyst for other investors to bid up the price?

- If I lose most of my investment, what will be the impact on my/my family’s wealth?

- Is the effort of analyzing and monitoring the investment worth it?

What financial mistake did you make in your 20s?

“When I was in my late 20’s, I inherited a small amount of money. Rather than deposit the money into a savings account where the returns were minimal, I wanted to invest the funds more aggressively, as my husband and I were earmarking this money for a college fund for our young children. I hired a small investment firm in my hometown that I had heard about through family and friends. Unfortunately, the money manager didn’t listen or understand my goals. He invested the funds very conservatively in money market funds, missing the fact that my risk tolerance was high given my young age and my goals were longer term.”

How would you advise your 20-something self not to make the same mistake?

As an investor, it was easy to get caught up chasing returns and seeking yield in a portfolio, but I now realize the low returns were indicative of a larger problem: the poor communication between me and my advisor.

There are numerous benefits to working with a financial advisor, and many that go beyond the returns realized on a portfolio. It’s important to find an advisor who:

- Understands Your Goals and Formulates a Plan: A good financial advisor will take the time to understand your financial goals, both short-term and long-term, and tailor their advice to align with your specific objectives. Creating a financial plan together provides a roadmap to reach those financial goals.

- Builds Trust and Communication: Effective communication is key in any advisory relationship. A financial advisor who listens builds trust by demonstrating that they value your input and are genuinely interested in your financial well-being.

- Adapts to Life Changes: Life is dynamic, and circumstances change. A financial advisor can adjust your financial plan to accommodate major life events such as marriage, the birth of a child, job changes, or retirement. Being attuned to your life changes ensures that your financial strategy remains relevant.

- Can Help Manage Emotional Responses: Financial decisions can be emotionally charged. A good advisor can help you navigate the emotional aspects of financial planning, providing guidance and support during market volatility or major life transitions. They can help you make rational decisions rather than reacting emotionally to market fluctuations.

- Provides Education and Empowerment: A financial advisor should also take the time to educate you about financial concepts, investment strategies, and other relevant topics. This enhances your financial literacy empowering you to make informed decisions about your money.

- Regularly Checks In: A financial advisor should schedule regular check-ins to review your financial plan, discuss any changes in your life or goals, and provide updates on your investments. This ongoing communication ensures that your financial strategy remains on track.

What financial mistake did you make in your 20s?

“After my husband and I were married, we moved to Miami and decided to buy our first home. With very little money to put towards a down payment, I decided to clean out my 401(k) to use as a down payment. Since it wasn’t a large account, I didn’t think about how much it would be worth years later!”

How would you advise your 20-something self not to make the same mistake?

Had I known then what I know now, we would have been more patient and changed our lifestyle habits to work toward building a down payment rather than borrowing from my future self.

It’s easy to get caught up in the excitement of buying your first home (it could also have been making any other large purchase) when retirement seems so far away. You may be tempted to use your growing retirement savings to put towards that purchase.

Here are some compelling reasons not to dip into these retirement funds:

- The penalties of cashing out are felt at tax time. If you are under 59½, there is a 10% penalty for withdrawing from a 401(k) and the distribution is taxed as ordinary income. For example, if your tax rate is 20% and you cash out a 401(k) of $10,000, a penalty tax of $1,000 would be owed in addition to an income tax of $2,000.

- It is possible to borrow from your 401k, making a loan to yourself to be paid back over time. But when you pay the pre-tax loan back, you will be doing so in after-tax For example, if you take out a loan of $10,000 and your tax rate is 20%, it will take $12,500 to pay it back.

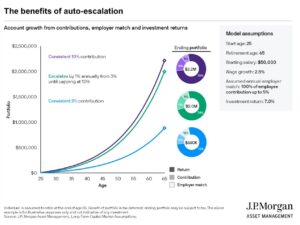

- Most importantly, you are losing out on the compounding growth of your money. The chart below illustrates three examples of 401(k) contributions and the long-term impact savings patterns had on the participants’ retirement balances:

- The saver in purple consistently contributes 10% per year.

- The saver in green uses an auto-escalation approach, whereby the contribution begins at 3% annually and increases 1% per year until capping at 10%.

- The saver in blue consistently contributes 3% per year.

Consistently contributing toward a retirement account can reap large long-term rewards. Even the lowest contributor shown above (in blue) would realize a substantial ending portfolio at age 65.

Look for more of these ‘lessons learned’ stories here.

If you’re a young adult looking for answers to your financial questions, we invite you to sign up for our Financial Foundations educational series. For more information and/or to register, click here.