As an investor, it is easy to get caught up chasing returns and seeking yield in a portfolio. Available benchmark information encourages this focus on matching or beating the market. Therefore, performance seems to be an easy way to evaluate your advisor. But what is missing in taking this approach? What actually are the benefits of working with a financial advisor?

The Russell Investments 2023 study, “Value of an Advisor,” quantifies multiple ways the advisor adds value to a client’s portfolio due to a holistic focus1:

Active Rebalancing of Investment Portfolios

When markets rise or fall, an investor’s portfolio can be meaningfully impacted, with the allocation becoming misaligned and the risk profile altered. These changes over time can have significant implications for the investor’s goals and the portfolio’s performance. For example, the Russell Investments study cited above illustrates how without any rebalancing, a portfolio allocated to 60% equities and 40% fixed income at the start of January 2009 would have adjusted to 82% equities and 18% fixed income by the end of 2022. Setting and forgetting adds undue risk to a client’s portfolio, further magnifying volatility during market swings. If that client also has withdrawal needs, the increased equity allocation makes liquidating assets for withdrawal more challenging, particularly if markets are down. An advisor adds the discipline of systematic rebalancing and monitoring, aligned with understanding investors’ goals. Regular rebalancing has the added benefit of harvesting losses or minimizing capital gains as an advisor concentrates on tax planning for their client.

Behavioral Coaching

An individual investor can be his own worst enemy since it is hard to put emotions aside and acknowledge biases that may exist. After all, it is their own money and future at stake. Advisors offer processes, objective advice and can be a sounding board when a client panics during heightened market conditions. Costly mistakes, such as selling at the bottom or not getting back into the market until near the top, can result. Advisors guide clients to establish a plan and remain accountable to it through the highs and lows of the markets. For example, when COVID hit in March 2020, many investors got spooked and sold their equity investments at the bottom, which resulted in significant realized losses in their portfolios. The market (S&P 500 Index) bottomed out at -34% that year, but in a dramatic twist, it ended in the green with a positive +16% year-to-date return2. Many investors, still hesitant, stayed on the sidelines in cash and lost out on this historic rebound. Who could have predicted this or the best time to re-enter the market? This example underscores the importance of an advisor as a behavioral coach and partner during times of volatility to provide clients with the tools and feedback to weather these storms.

Customized Planning

Each investor presents unique experiences and goals, so an advisor does not use a one-size-fits-all approach to meet the client’s needs and circumstances. Advisors provide tailored financial planning and advice depending on the stage of life the client is approaching. Some questions that arise include buying a home, funding kids’ education, considering estate planning, accumulating retirement savings, or selling a business. Whether the client is in the accumulation stage or planning to retire, a good advisor must communicate effectively to ensure the client makes informed decisions by fully understanding and digesting their options. Frequently, the advisor will include the client’s children in the planning discussion, not only to educate them financially but also to facilitate a multi-generational approach to wealth transfer.

Tax-Efficient Planning & Investing

Taxes are a huge pain point for most of us, but individuals don’t fully understand the tax implications of some of their investment choices until they are faced with a tax bill the following April. Advisors can employ strategies during the year to minimize taxes. Some strategies include tax loss harvesting, utilization of tax-efficient products, contribution strategies to lower taxable income, and gift transfer strategies. While tax strategies do not count towards your portfolio returns, they provide monetary results in savings on your tax bill each April.

Advisors act as financial coaches, not only by investing and managing clients’ portfolios but also by providing holistic counseling and education that can create tangible benefits for clients. These benefits are often more nuanced than portfolio performance. For advisors, the relationship with a client is a marathon, not a sprint, as they initially dive deeply into their financial profile and continue to stay apprised of the changes in their clients’ lives in the ensuing years. The client’s financial plan is monitored and reviewed regularly, and as changes arise, the client and advisor evaluate how those changes might impact the plan.

It is important to do due diligence in finding an advisor who provides comprehensive services and puts your interests first as a fiduciary. To better differentiate between the two main types of advisor structures, read our blog.

Go it Alone?

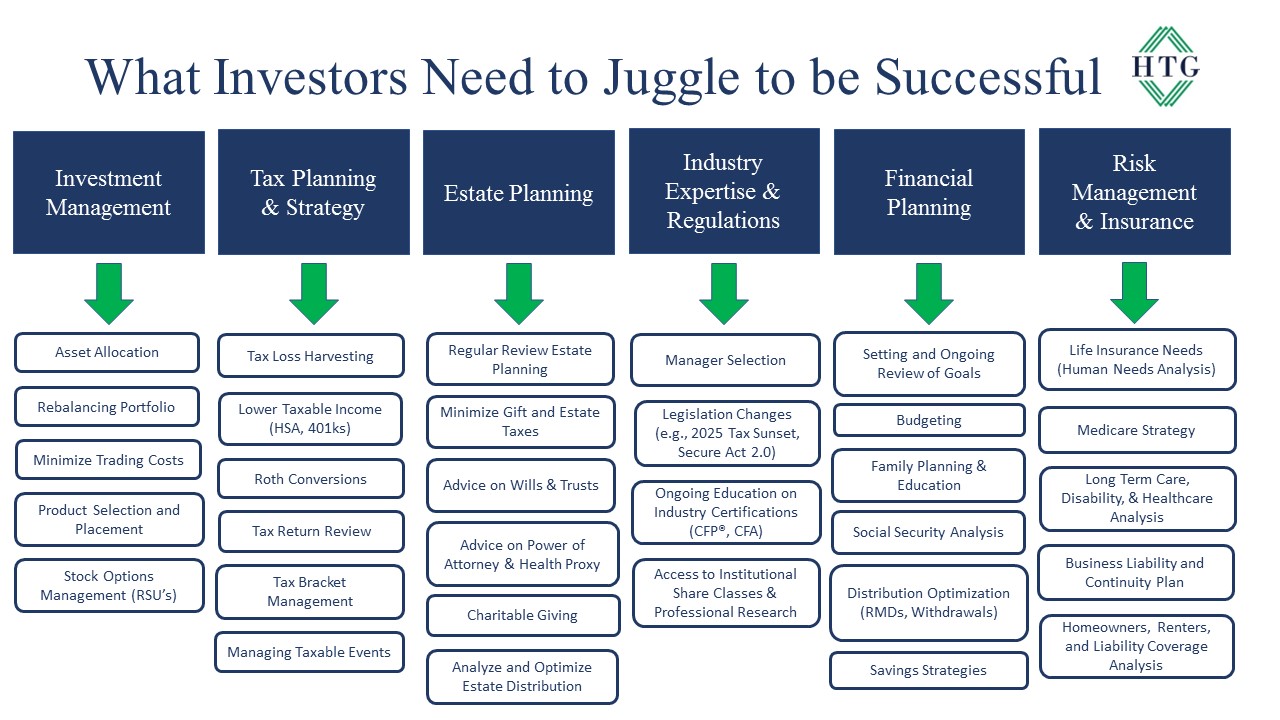

As the chart below illustrates, for an investor to “go it alone,” he needs to pay attention to a myriad of financial considerations.

Will this investor have the time to manage their portfolio consistently, holding themselves accountable along the way? Imagine layering these responsibilities on top of keeping up to date on a changing regulatory environment. It is important to evaluate the cost and potential impact of managing your finances on your own.

When you weigh all these factors, having a financial coach in your corner just might make sense!

1 “Value of an Advisor” study (2023) Copyright © 2023 Russell Investments Group, LLC. All rights reserved.

2 “Guide to the Markets”, J.P. Morgan Asset Management