Transitions bring uncertainty.

HTG's financial advisors bring clarity.

Serving clients in Connecticut & nationwide.

What You’ll Gain with HTG

Life transitions bring a flood of financial questions, and you shouldn’t have to face them alone. HTG helps take financial decisions off your plate – and stress off your shoulders – so you can focus on your loved ones, knowing your future and theirs is secure.

Whether you’re navigating retirement, widowhood, divorce, a windfall, or a major career move, we’ll help keep your goals on track and help you feel more in control of your financial future.

Peace of Mind, Backed by

Expertise

Relax knowing your financial plan is carefully managed by a team of experienced advisors.

A Trusted

Advisory Team

With our collaborative approach, you don’t just get one advisor – you get the combined expertise of our entire team.

A Personalized &

Collaborative Partnership

We build a financial plan around your financial goals and actively adjust it as your life evolves, keeping you in the loop every step of the way.

Services

Financial Advisory Services

The following services are included in our comprehensive financial planning.

Inheritance & New

Wealth Management

Our team – including a CDFA® (Certified Divorce Financial Analyst®) – understands the financial complexities of divorce. We’ll work with you and your attorneys to analyze financial data and provide a clear path forward.

Employee Stock Options and Restricted Stock Planning & Management

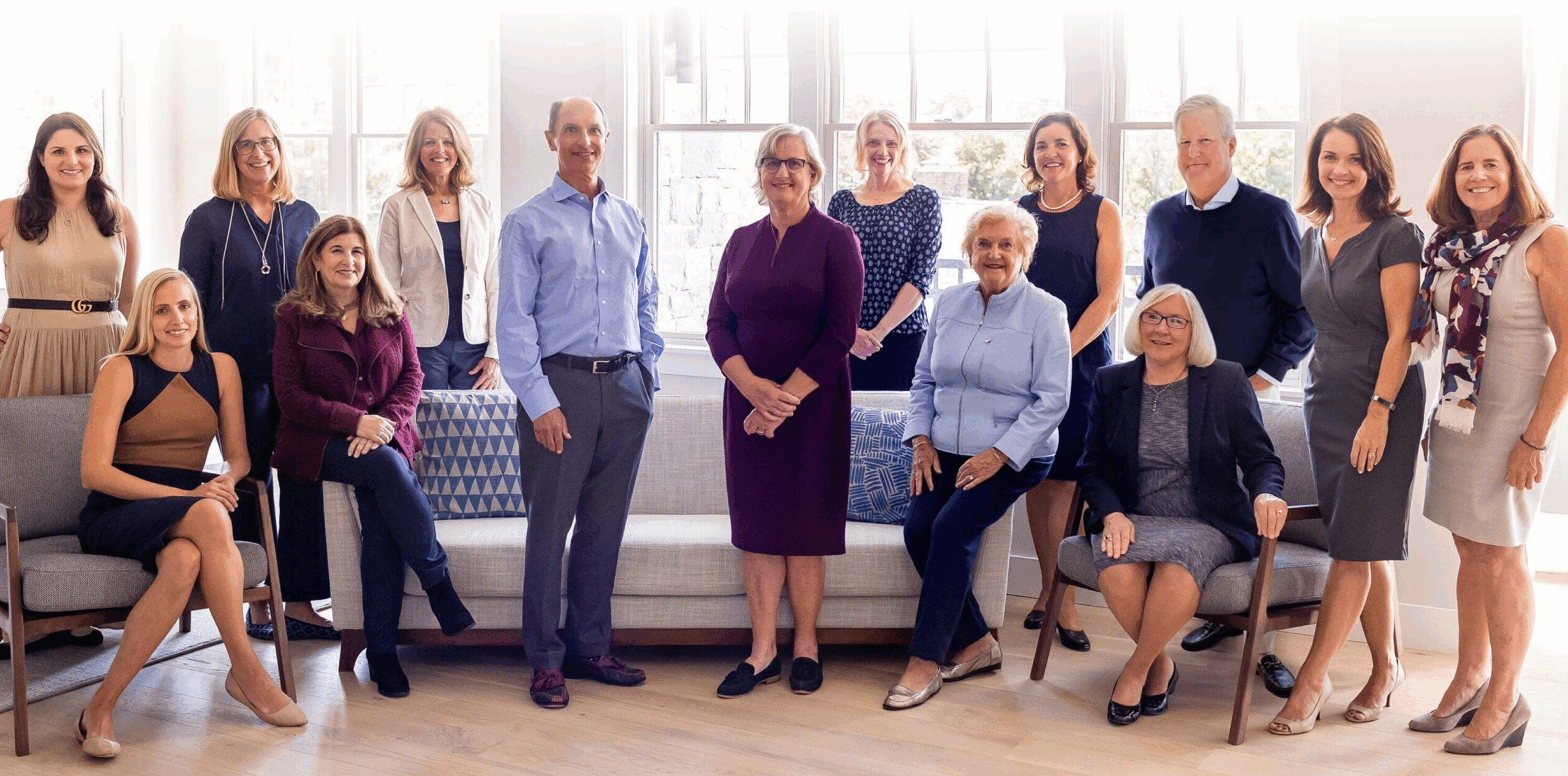

About HTG Advisors

HTG Advisors specializes in helping clients manage their finances during life transitions, providing guidance, empathy,

and collaboration every step of the way. When life changes – and your financial needs change with it – we’ll be here to

answer your questions, adjust your plan, and account for future changes.

We are your financial sounding board, always just

a phone call away. When you partner with HTG,

you’ll receive:

- Expertise from seasoned, fee-only fiduciaries

- Goals-based, customized plan for long-term wealth

- Transparent communication & collaboration

- Ongoing investment management & financial education

Our Engagement Process

Free Introductory Call

Collaborative Planning

Ongoing Relationship

We actively monitor your financial situation and make adjustments as needed, with your input every step of the way.

What Our Clients Say

Reviews are based on unique experiences and may not be representative of all client experiences. No cash or non-cash compensation is provided to those leaving a review. Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results. Additional information about HTG Investment Advisors is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary report.

Who We Help

Services Tailored to People in Transition

We’ll adapt your plan to meet changing financial situations, investment goals, and risk tolerances during major life shifts.

We might be a good fit if you:

- Are retiring or are approaching retirement

- Are navigating divorce or widowhood

- Are experiencing a career pivot

- Have recently received an inheritance

- Have restricted stock or stock options from your employer

- Don’t want to manage (or don’t feel capable of managing) your investments alone

- Are entering the empty nest phase

- Need financial guidance during a major life transition

We’re here to help you navigate the unexpected.

We’ve seen it all and can help you navigate your financial situation, even when it seems impossible or overwhelming.

Success Stories

Young Family

with Full Plate

When to

Retire

Sharing Substantial Wealth and Creating a Legacy

Download your copy:

5 Essential To-Dos to Be Ready for Retirement in 5 Years

Lead Capture Home

"*" indicates required fields

news & blog

Education and Thought Leadership

Visit our blog for the latest market news, trends, and financial strategies.

Inherited IRA Distribution Rules: What Beneficiaries Must Know

Inherited IRA rules have become increasingly complex with the SECURE Act and SECURE 2.0. New requirements took effect in 2025... READ MORE

Read MoreEliminate the stress of making

big financial decisions alone.

With decades of experience and proven strategies, we help you make smart financial choices with confidence and clarity. Start with a no-pressure consultation.