The education savings vehicle that keeps getting better!

With today’s average cost of a 4-year college education running at $101,210 for a public college and $230,290 for a private college and increasing at 5% per year1, there is no time to waste in saving for your kids’ or grandkids’ futures.

Increasingly, parents are having to work longer to meet the dual objectives of educating their children and saving enough for their retirement. Or worse, they are dipping into their retirement savings or taking 401(k) loans. In addition to potentially shortchanging retirement goals, the unintended consequences of this are that cash withdrawals add to parents’ taxable income, which could push them into a higher tax bracket and jeopardize the student’s ability to receive financial aid.

What to do? As with most financial goals, the earlier you set them, the better off you will be. The 529 college savings plan is a solid way to start saving for what is one of the biggest financial expenditures a family will make. But what are the benefits of a 529 plan?

The 529 has advantages:

- Tax-free investing and withdrawals for qualified education expenses

- No income limits on contributors

- State tax breaks on contributions (available only in certain states)

- High annual contribution amounts without incurring gift taxes – can superfund $170,000 per beneficiary in 2023 with five years of tax-free gifts made in one year

- Contributed assets are removed from the donor’s taxable estate

- Account owner retains control of the account

- Beneficiary can be changed to an eligible family member without tax consequences

- Up to $10,000/year can be used for K-12 public, private, or religious school (state rules may differ)

- One-time payment of up to $10,000 of principal or interest for qualified education loans (state rules may differ)

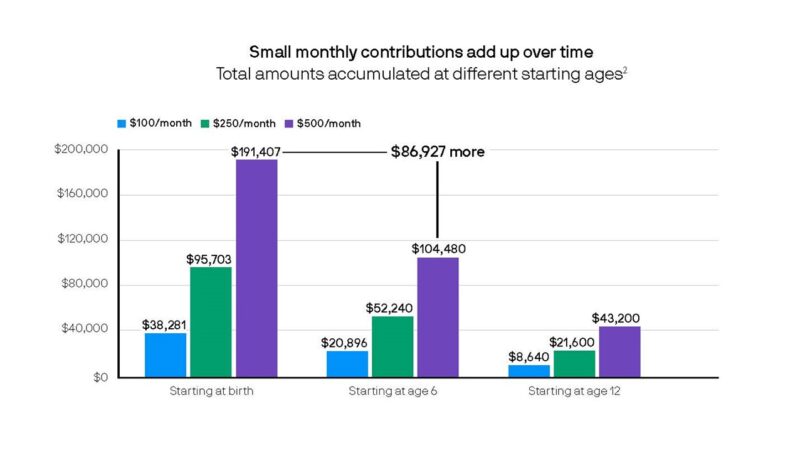

And never underestimate the power of compounded earnings. The earlier you start saving, the better!

The chart below from JP Morgan shows the advantage of starting early and that even small monthly contributions add up over time. Starting at birth and contributing $500/mo. with an investment return of 6% compounded monthly, you will have $86,927 more at age 18 than if you started contributing the same amount at age 6. And making automatic recurring transfers directly from a bank account to a 529 account is a sure way to keep you on track.

New and improved 529 features

Two new developments, which are rolling out this year, are good news for grandparents and account owners with excess funds in their accounts.

The grandparent-owned 529

Grandparent-owned 529 plans have become a popular way to save for college and with good reason. With a 529 plan, you can build an educational legacy for your grandchild while taking advantage of tax and estate planning benefits.

A major drawback, however, has been that 50% of distributions from grandparent-owned 529s have historically been counted as income to the student, thereby reducing eligibility for financial aid.

The Free Application for Federal Student Aid (FAFSA) is changing, with final approvals expected this fall (effective for the 2024-2025 school year). Under the new rules, distributions from grandparent-owned 529 accounts will no longer count as income to the student and will be excluded from the FAFSA calculation of both assets and income.

529 to Roth IRA Rollovers

Effective January 1, 2024, a new rule in the SECURE Act 2.0 will allow 529 funds to be moved directly to a Roth IRA. This is good news for those with unused account balances. Here are the details/limitations:

- The beneficiary of the 529 and the owner of the Roth IRA must be the same person

- The Roth owner must have compensation (earned income)

- Income limits do not apply as with regular Roth IRAs

- The amount contributed each year cannot exceed the annual IRA contribution limit, and is combined with “regular” Roth IRA contributions

- The 529 account must have been open for 15 years with the most recent contribution having been made at least five years ago

- Maximum lifetime limit is $35,000 per beneficiary (not indexed for inflation)

Since the first 529 college savings plans became available in 1996, improvements have continued in the investment offerings and pricing. Every state has at least one type of 529 plan. You can compare plans here or here.

Have you been considering opening a 529 for your child, grandchild, or other family member, but haven’t taken it to the next step? Get started! There are number of online tools at your disposal. Or, contact your advisor to discuss your goals and how the benefits of a 529 college savings plan can help you meet those goals.

1 J.P. Morgan Asset Management, using The College Board, Trends in College Pricing and Student Aid 2022. Future college costs estimated to inflate 5% per year. Average tuition, fees, and room and board for public college reflect four-year, in-state charges.

2 J.P. Morgan Asset Management. This hypothetical example illustrates the future values at age 18 of different regular monthly investments for different time periods. Chart also assumes an annual investment return of 6%, compounded monthly. Investment losses could affect the relative tax-deferred investing advantage. This hypothetical illustration is not indicative of any specific investment and does not reflect the impact of fees or expenses. Such costs would lower performance. Each investor should consider his or her current and anticipated investment horizon and income tax bracket when making an investment decision, as the illustration may not reflect these factors. A plan of regular investment cannot ensure a profit or protect against a loss in a declining market. This chart is shown for illustrative purposes only. Past performance is no guarantee of future results.