“Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.” – Warren Buffet

Human beings fear the unknown. To reduce our anxiety and increase our feeling of certainty, we seek out people who predict the future.

This carries over to our financial health and personal wealth. We embrace economists who state with conviction that “personal spending will be down by 6% in the fourth quarter” or “the Fed will raise interest rates in June.”

Yet precise predictions create a false sense of accuracy.

While we deeply want to believe that experts can lead us to understand how events will affect investments, financial market predictions have proven unreliable. Their failures are due to the impossibility of modeling complex environments which are impacted by external events or human behavior.

Research has also identified an over-confidence bias. The more we know of a topic, the more we over-estimate the accuracy of our estimates.

If market predictions have greater entertainment than economic value, how can we best address uncertainty?

1. DON’T ATTEMPT TO PREDICT THE MARKET

Some professionals, for example, use a country’s GDP growth to predict future performance of that stock market. Even if you were able to predict GDP growth (which economists have failed to do), the correlation with stock market returns is weak. Often the expectation of future growth is already priced into the market, eliminating excess returns to new investors.

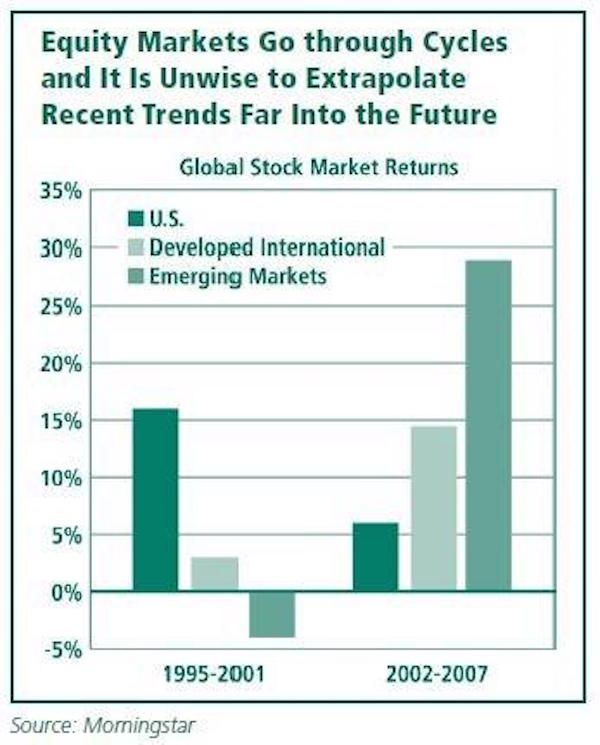

Chasing yesterday’s winners also does not work, as illustrated in the graph on this page. The U.S. out-performed developed international and emerging markets from 1995 to 2001, then underperformed from 2002 to 2007.

2. FIND THE VALUABLE INFORMATION AMONG ALL THE DATA

Engineers refer to this as distinguishing the signal from the noise. For example, the Federal Government updates thousands of statistics on the U.S. economy on a monthly basis. With each announcement you can expect a series of prognostications. But no one, not even the U.S. Federal Reserve Bank, knows where interest rates will be at year end.

To avoid the distraction of too much data, HTG looks for long-term trends. For example, we have confidence that nominal interest rates will be higher in the future since there is a strong desire on the part of the Government for moderate inflation, but we can’t predict the exact timing.

3. INVEST IN A DIVERSIFIED PORTFOLIO

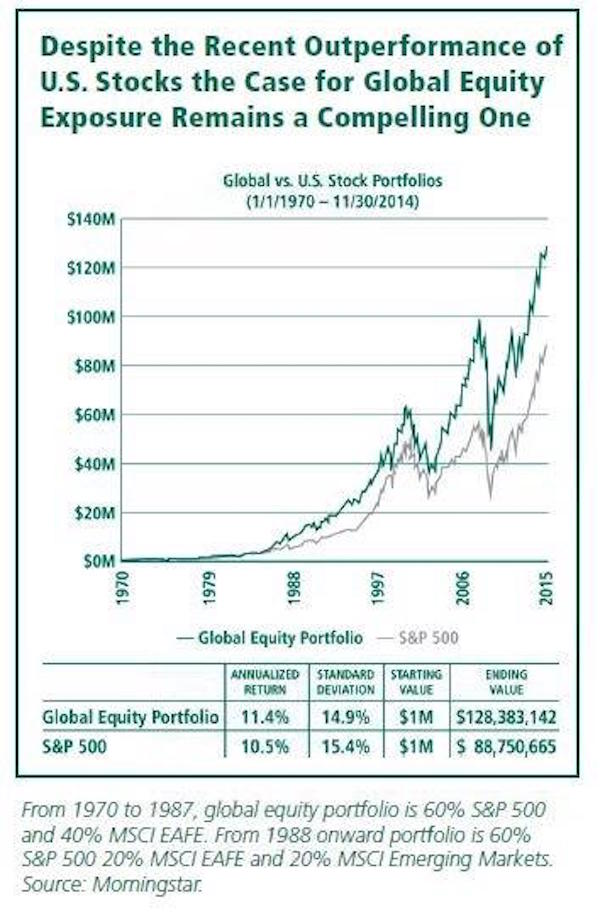

Investors holding a globally diversified equity portfolio have enjoyed better results as compared to those concentrating in just the U.S. market (see graph below).

A contributing factor is that there is a much larger set of opportunities if one invests beyond the U.S. market. With the United States now representing only 20% of world GDP, there are many attractive companies beyond our borders. Why limit automobile sector exposure to Ford and GM? Which may be a better investment going forward, Apple or Samsung? Google or Baidu? Exxon or Shell?

Global diversification provides more sources of returns while lowering risk.

HTG embraces evidence-based rather than prediction-based investing. We seek well researched sources of long-term returns rather than unreliable short-term forecasts.

Dimensional Fund Advisors (DFA) is an excellent example of a firm practicing an evidence-based investment strategy. Based on the extensive research of Nobel Laureate Eugene Fama and Kenneth French, DFA has identified a long-term, risk-adjusted return benefit from value stocks and small company stocks (the “signal”). In response, DFA constructs cost-effective portfolios with tilts towards the dimensions of value and small size within broad exposure to the overall stock market.

We encourage you to separate the “signal” from the “noise” and distinguish between financial entertainment and evidence-based investing. We appreciate it’s increasingly hard to do with 24-hour news shows needing to fill air time and daily “breaking news” alerts on our cell phones, but forecasting and market timing simply do not work.

It is thoughtful diversification that stands the test of time.