The goal of tax-efficient investing is simple: maximize the amount of investment return you keep by minimizing how much is lost to taxes, without jeopardizing the integrity of the portfolio.

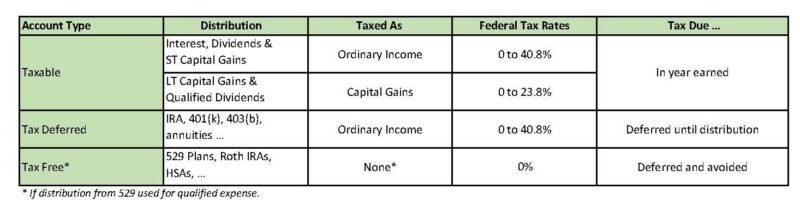

With a U.S. tax code of nearly 75,000 pages, achieving this simple goal can be complex. The box below distills the primary Federal tax rules as they pertain to investment accounts.

The Federal tax system taxes long-term capital gains and qualified dividends at a lower preferential rate than ordinary income and short-term capital gains.

To minimize taxes, some investors simply favor long-term capital gains and qualified dividend income over ordinary income. Other investors exclusively hold tax-exempt bonds within their preservation assets.

Both practices, taken to extremes, reduce diversification leading to excessive concentration risk, so must be used with caution. In managing clients’ assets, HTG uses three additional techniques to optimize after-tax returns.

TECHNIQUE #1: MASTER THE ART OF ASSET LOCATION

Choosing which investments to place in a taxable, tax-deferred or tax-free account can significantly impact your tax bill. Unfortunately it’s not as simple as just placing stocks or stock funds in a taxable account because the frequency of trades can impact tax efficiency.

Consider a family with assets evenly spread across all three types of accounts. Tax-efficient investments (low turnover U.S. equities and municipal bonds) would be placed in taxable accounts, tax-inefficient ones (high turnover strategies and high yield fixed income) in tax-deferred accounts, and high growth investments in tax-exempt accounts.

If financial assets are not equally distributed across account types, then there are fewer options for tax savings.

Another issue is that there may be different goals and time horizons among accounts. For example, tax-deferred retirement accounts often have long time horizons and would benefit from the tax-deferred compounding of equities, especially if the investor’s tax rate will be significantly lower during retirement when distributions are taken from these accounts.

529 College Savings Plans, while often aggressively invested when the beneficiary is young, should be shifted to a preservation-focused strategy as college approaches, despite their tax-free status.

In both cases above, the challenge is to balance tax-efficient asset location with efficient goal-based asset allocation.

TECHNIQUE #2: LOOK BEYOND ONE YEAR

Consider how your tax rate may change over time. While we can’t predict changes in the tax code, it is possible to estimate how your taxable income may change and the implication for your marginal income and capital gains tax rates.

If a financial plan indicates the likelihood of being in a lower tax bracket in the future, then you may consider waiting to realize gains.

However, it is important not to let the pursuit of tax efficiency lead to suboptimal investment decisions. For example, holding a large position in appreciated stock in order to postpone paying capital gains tax exposes you to a potential loss much greater than the capital gains tax savings.

Charity and death have special tax implications.

If charitable bequests are planned, then highly appreciated securities can be earmarked for that purpose and preferably transferred to a charitable gift trust or donor advised fund rather than sold in a taxable account. This ensures a double tax savings: avoiding capital gains and receiving an income tax deduction.

Another special circumstance is when an investor has a limited life expectancy. Then any unrealized capital gains in taxable accounts will be “stepped up” to their market value when the owner passes away. This strategy avoids capital gains taxes altogether.

TECHNIQUE #3: MINIMIZING NET REALIZED ANNUAL CAPITAL GAINS

A critical component of this technique is to keep good records of purchases and sales. Accurate records offer the opportunity to actively manage when to realize gains and losses.

While gains are always preferred over losses, even losses may create value in a taxable account since they offset gains for tax purposes.

One technique to capture this value is called “tax loss harvesting.” When a security or fund is sold at a loss, the proceeds can be held in cash, used to rebalance the portfolio or invested in something similar but not identical.

In all cases, in order to utilize the loss to reduce capital gains, the identical security or fund cannot be re-purchased within 31 days to avoid a “wash sale.”

Achieving the goal of tax efficiency requires an in-depth understanding of your tax situation, how it may change in the coming years and available tax reduction techniques. With this knowledge, it is possible to create a tax-efficient portfolio consistent with your financial goals.

Tax efficiency adds value if pursued thoughtfully and not at the expense of sound investment decisions.