With the U.S. markets outperforming their international counterparts in eight of the last ten years, investors may wonder if they should be invested in foreign companies or may be tempted to abandon their international equity exposures in favor of U.S. stocks.

Investing internationally means holding equities from a company whose headquarters and principal stock market are based abroad. Investing overseas has long been recognized as a prudent strategy to increase diversification within an equity portfolio.

Yet, many investors are locked into a home bias investing in only U.S. stocks and don’t realize how much this lack of diversification can cost them over the long term.

No one investment category – not even one as broad and deep as U.S. stocks – is likely to outperform consistently or permanently. Markets are notorious for cycling irregularly up and down, and equity markets are particularly adept at catching investors off guard.

There are many reasons that investing internationally remains a sound strategy and why we at HTG consistently include international stocks as part of our equity allocations.

International markets are too large to be overlooked.

Over 40% of the world’s value of public companies lies beyond U.S. borders. By investing only in the U.S., you may be missing out on a large piece of the global investment pie and hampering your return potential. As the chart illustrates here, the size of a country may not necessarily correlate to its investment opportunities.

When you own more of one security, you are overemphasizing that security and, by definition, owning less of something else. This begs the question: what are you not owning? Take the pharmaceutical industry, for example. When you overemphasize the U.S. market in your portfolio, you may own more of Merck, Pfizer, and Johnson & Johnson and less of Novo Nordisk, Novartis, AstraZeneca, Bayer or GSK. Are you confident that these U.S. pharmaceutical companies will produce the best drugs in the future? Likewise, in the auto industry: if you overemphasize U.S. companies, you will own more of Ford, GM, and Tesla and less of Toyota, Honda, Mercedes, and BMW.

Global companies operate worldwide.

Now more than ever, businesses are competing globally and earning revenue from all parts of the globe. For example, in the consumer products industry, Procter and Gamble (P&G), a well-known U.S. company, competes against Unilever (U.K.) and L’Oréal (FR).

P&G earned over half its revenue outside the U.S. in recent years, while Unilever earned less than 5% within its U.K. home base, and approximately 25% of L’Oréal’s revenues came from North America1.

By removing country boundaries, investors are free to seek the best companies within an industry regardless of their country of origin. Some argue that European companies are more adept and familiar with doing business in emerging markets than U.S. companies, and hence are in a better position to capture the higher growth coming from those markets.

The risks of investing abroad are no greater than in the U.S., just different – use them to your advantage.

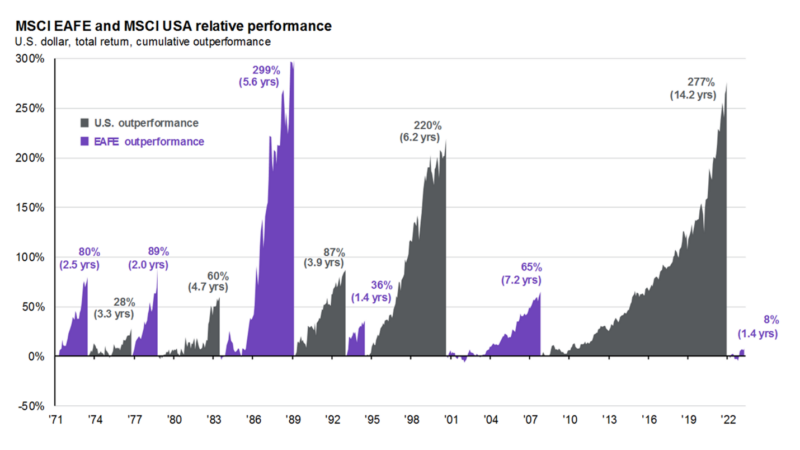

Performance cycles between U.S. and non-U.S. markets. While the U.S. market has outperformed other developed markets for most of the last decade, that has not always been the case. The graph below, from analysts at JPMorgan, provides a fifty-year view, and illustrates the relative performance of developed foreign markets, often referred to as “EAFE” (Europe, Australasia, and the Far East) and the U.S. Purple represents periods when foreign markets enjoyed greater appreciation than the U.S. market. Clearly, there have been multi-year cycles of under and over-performance. This cycle again changed in 2022 when developed markets outperformed U.S. markets, though both posted losses.

Source: FactSet, MSCI, J.P. Morgan Asset Management.

Regime change determined when cumulative outperformance peaks and is not reached again in the subsequent 12-month period.

Guide to the Markets – U.S. Data are as of March 31, 2023.

A portfolio’s return is enhanced by seeking assets that fluctuate independently of one another. Stock markets around the world are not perfectly linked. Each is driven by a different mix of investors, companies, trade flows, and local economic factors. These differences provide a diversification of risks.

While investing abroad does introduce exposure to foreign currencies, the risk is mitigated by two factors:

- Major corporations generate profits in a variety of currencies. This is equally true for a company listed on a U.S. stock exchange as it is for one listed on any other exchange. While the foreign stock may be denominated in another currency, their earnings are not necessarily in that currency, and,

- While the U.S. Dollar benefits from its current role as the world’s premier reserve currency, it will appreciate or depreciate in relationship to the other currencies. Global investing provides U.S.-based investors with a hedge against U.S. Dollar depreciation.

Consider valuations and potential for growth.

Because U.S. stocks have outperformed in recent years, utilizing the concept of rebalancing investment allocations to include more non-U.S. investments is a sound strategy and follows the adage of buying low and selling high. Many non-U.S. stocks may be well positioned to benefit from both higher economic growth outside the U.S. and lower starting valuations.

While U.S. dividend-oriented strategies have fared well historically, international stocks have also offered favorable dividend values. Average dividend yields for December 2013 through December 2022 for U.S. equities were 1.75% and 2.88% for non-U.S. equities 2.

At HTG Advisors, our investment management philosophy is to invest globally and implement diversified portfolios through cost-efficient funds. If you want more information on how we invest or about our wealth advisory services, please contact us.

1 FactSet, Market Cap as of Jan 2022, and IBISWorld

2 Vanguard and FactSet, as of December 31, 2022. U.S. equities are represented by MSCI USA Index and non-U.S. equities are represented by MSCI World ex USA Index