The Golden Rule for College Savings – Start Early!

May 29th is 529 College Savings Day, a day to highlight the importance of planning and saving for higher education expenses with 529 plans. If you are the parent (or grandparent) of a young child, it is not too early to start saving for college. As new parents you are no doubt juggling busy schedules and are focused on diapers and daycare, which may make it challenging to look so far into the future. When it comes to investing in your child’s future, however, time is on your side now, so use it to your advantage.

College costs continue to rise …

It is a grim fact that since 1983 college tuition has risen at a rate vastly higher than the cost of living. In a recent study, J.P. Morgan Asset Management reported that the projected cost of a four-year college education for a child born today is $235,000 for a public school and $536,000 for a private school.

Rising costs are a big challenge for families trying to pay for higher education. Saving early and consistently is the best way to prepare for what might just be the biggest investment your family makes during your lifetime.

Start saving early!

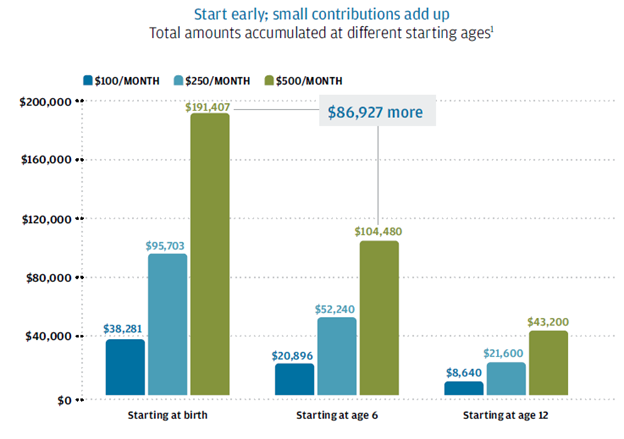

As the JP Morgan Asset Management graph* below demonstrates, savings of $250 per month starting when your child is a newborn will grow to $96,000 by age 18, assuming a 6% return compounded monthly. That same amount and return, if starting at age six, will amount to $52,000. So, starting early is clearly an advantage. Automatic monthly savings plans are an excellent way to improve the likelihood of saving consistently.

There are several ways to save for college, but this blog will focus on the 529 college savings plan, an investment plan with incentives to save for education. 529 plans have been around for 25 years, and Educationdata.org reports that there are 14.8 million 529 savings plans with over $425 billion in assets in the US today. There are two types of 529 plans: prepaid and savings plans. We focus here on the savings plan.

The advantages of a 529 savings plan:

- Tax-advantaged savings: Contributions are made with after-tax dollars, but the investment earnings are tax-free if the funds are used for qualified education expenses. Additionally, many states offer a state income tax deduction for contributions made to your state’s plan.

- Account flexibility: With 529s, there are no income limits, age limits, or annual contribution limits or minimums. Also, since you control the funds in the account, you can change the beneficiary to another eligible family member anytime.

- Minimal impact on financial aid: 529s are parent-owned assets and, as such, are factored into financial aid formulas at lower rates than student-owned assets, thereby limiting the impact on financial aid eligibility.

- Generous gifting limits: 529 plan contributions qualify for annual gift tax exemptions ($16,000 per beneficiary per year in 2022, or $32,000 for joint filers).

- Investment options: Most plans offer age-based or customized plans. Fees and expenses vary between plans but are reasonable overall. Automatic payment plans are available to make saving even easier.

- Expanded uses: 529s may now be used for K-12 education expenses (up to $10,000), student loan repayment ($10,000 lifetime maximum), and for some apprenticeship programs.

Extended family can help, too!

The 529 may be a good option for grandparents, too. The 529 offers a frontload option whereby you can contribute five times the annual gift exclusion in a lump sum ($80,000 per person or $160,000 for joint filers). Your contribution is considered a completed gift for estate planning purposes (meaning those assets are no longer part of your estate). Beginning with the 2025-26 school year, the new FAFSA financial aid application will no longer require students to disclose receipt of funds from a grandparent-owned 529. All of these benefits make for a powerful way to help your family with future college costs and create a legacy.

College savings can be a family affair. Parents are expected to contribute a far greater percentage of their income today than ever before.

When family members and friends ask what they can give your child to celebrate a birthday or holiday, encourage them to give the gift of education by contributing to your child’s college savings.

A word about grants and scholarships:

Sallie Mae’s How America Pays for College 2021 reports that for the 50% of families receiving need-based grants, the 2020-2021 average grant was just under $5,000, and of the 56% of families receiving merit-based scholarships, the average amount was just over $7,000. The consequence of failing to save can be severe: having to forego college, or not being able to attend the college of choice, or incurring significant debt, which exacerbates the already high cost of education.

The optimal college saving solution may incorporate several strategies. The important thing is to set a goal, make a plan and get started!

For more information, talk to your advisor. You can also visit savingforcollege.com.

* Source: JP Morgan Asset Management- College Planning Essentials 2021.

- J.P. Morgan Asset Management. This hypothetical example illustrates the future values of different regular monthly investments for different time periods. Chart also assumes an annual investment return of 6%, compounded monthly. Investment losses could affect the relative tax-deferred investing advantage. This hypothetical illustration is not indicative of any specific investment and does not reflect the impact of fees or expenses. Such costs would lower performance. Each investor should consider his or her current and anticipated investment horizon and income tax bracket when making an investment decision, as the illustration may not reflect these factors. A plan of regular investment cannot ensure a profit or protect against a loss in a declining market. This chart is shown for illustrative purposes only. Past performance is no guarantee of future results.

- ISS Market Intelligence, 529 Industry Analysis 2020.