Laurie, a single woman living in Boston, just turned 70. She loves her work as a consultant to startups and plans to work as long as she can. Laurie has been a disciplined saver over the years and has amassed approximately $3,000,000 in a mix of taxable and retirement assets. Social security starts this year, and she will be subject to required minimum distributions from her retirement accounts in three years. While working, she does not need these distributions from her portfolio to cover her expenses. In addition, her family has a history of above average longevity and Laurie has not purchased long-term care insurance. She has been thinking about how to best preserve her assets for her lifetime and also protect against the risk of long-term care costs. She decides to investigate purchasing a Qualified Longevity Annuity Contract.

Qualified Longevity Annuity Contracts (QLACs) have existed for about a decade. 2014 legislation made this type of annuity contract available to help to protect against increasing longevity.

What is a Qualified Longevity Annuity Contract (QLAC)?

A QLAC is a type of deferred income annuity purchased using funds from a qualified retirement account, including an IRA (but excluding Roths and inherited IRAs).

In exchange for a payment or series of payments, an insurance company will guarantee a stream of income at some point in the future. This would allow Laurie to delay required minimum distributions and the associated taxes from the portion of the money used to buy the QLAC.

Bottom line, a QLAC allows money to grow tax-deferred for longer.

Retirees are mandated to start required minimum distributions from their qualified retirement accounts by age 73-75, depending on their birth year. However, income from the portion of the money used to buy the QLAC can be deferred until age 85.

Guaranteed income payments are based on age, gender, single or joint life benefit, number of years of deferral and the amount purchased. Typically, the longer the deferral, the greater the income distribution. This guaranteed QLAC income may start at a time when high long-term care/medical expenses can be used to offset some of the income tax liability from the distributions.

Why have QLACs been in the news as of late?

The 2022 Secure Act 2.0 made some changes to QLAC rules which make this investment more attractive.

First, the limit that can be used to fund a QLAC increased to $200,000 of an individual’s qualified retirement accounts. This is per person, so a couple can devote up to $400,000 if both have qualified accounts. (Previously, only the lesser of 25 percent of the aggregate account balance or $145,000 of your qualified retirement funds could be used to fund a QLAC.)

In addition, new rules allow for joint life annuities, so the guaranteed income can last until the second spouse’s death, where previously only single life annuities were permitted

Who would benefit most from a QLAC?

The best candidates for QLACs are those between ages 60 and 75 who:

- Expect a long life and have average or above average health.

- Do not need their full RMD for living expenses.

- Are concerned about outliving their retirement savings.

- Will be in a high to moderate tax bracket once RMDs begin.

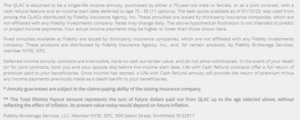

Example of $200k QLAC benefit

Using Fidelity’s online interactive widget in Laurie’s case, if she buys a $200,000 QLAC at age 70, she could add $56,850 of annual income starting at age 85 when she will likely be retired and perhaps have higher medical expenses. If she lives to age 95, total income received will be $568,496. If she lives to 100, a total of $852,744 will be paid out.

Source: https://www.fidelity.com/viewpoints/retirement/rmds-to-retirement-income-for-life

Tax savings and rate of return

A QLAC allows Laurie to defer taxes on the $200,000 in retirement funds that she invests in a QLAC, until the annuity payments begin when she is 85 and may be in a lower tax bracket. Removing the $200,000 from her IRA reduces the amount of her annual required minimum distributions between ages 73 and 85. This results in tax savings, adding to the QLAC benefit.

What are the negatives of QLAC?

A QLAC sounds pretty good, right? But there are drawbacks:

- Limited flexibility: Once a QLAC has been purchased, there is generally no option to change the contract terms or receive a lump sum payment.

- Potential penalties: If an individual withdraws funds from a QLAC before the age specified in the contract, there may be early withdrawal penalties.

- Potential lower growth: Because payments are usually fixed and funds in a QLAC are generally not invested in stocks or other growth-oriented investments, there is a potential to miss out on potential growth in retirement savings.

Other considerations with QLACs:

- The compounded rate of return of the QLAC is not disclosed upon purchase and the actual return will be based on longevity—i.e. the longer the life, the higher the rate of return.

- The annuity sum is not invested or subject to market volatility, but the guaranteed income is subject to the health of the insurance company paying the claim (i.e., if the insurance company fails, the guaranteed income is at risk).

- The cost is built into the rate and income formula of the QLAC. There is not a transparent, separate fee or charge.

- This type of annuity must be designated a QLAC at issue- you cannot convert an existing annuity to a QLAC.

- Some QLACs offer return of premium and cost of living adjustment options.

Who offers QLACs and what are the options?

QLACs are sold through insurance companies. It is important to evaluate the company’s strength/rating and then choose the product options to suit your particular needs:

- Income start date

- Payout options (single or joint)

- Return of premium/death benefits

- Fees

- Surrender penalties

- Inflation protection

Summary

For some retirees, investing in QLACs can be a part of a broader retirement plan, offering a balance between fixed and variable income. By providing a steady income in the latter part of retirement, QLACs can help mitigate the risk of a long life and depleting assets prematurely. Working with a financial advisor to evaluate your particular situation is recommended.