After suffering through many years of low interest rates, investors are relieved to finally be earning a real return on their cash. Money market funds continue to yield north of 5% after earning less than 1% not that long ago. However, we are also experiencing a high level of volatility in the equity markets, which has many investors on edge. So, it is no surprise that more clients have asked, “Why don’t we put all our assets in cash? We can earn 5% risk-free and wait to see how a potential recession plays out.” On the surface, it might sound like a great idea – risk-free returns, no more market volatility, and a restful sleep! But, consistently timing the market is nearly impossible, and being out of stocks, even for a short period of time, can severely impact returns. Moving to cash, even for a short time, could hurt long-term returns and jeopardize long-term goals.

No One Consistently Times the Market

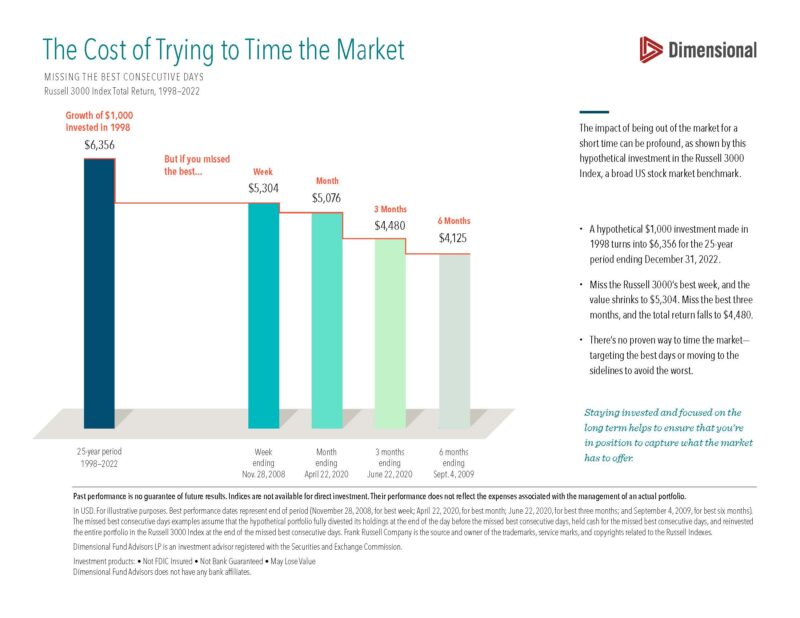

Moving to cash involves two decisions: 1) when to sell equities and 2) when to eventually buy back into the market. Investors might get the two decisions right some of the time, but it is impossible to predict both consistently. Being out of the market, even for a short period of time, could have a dramatic impact on long-term returns. As shown in the chart below from Dimensional Fund Advisors, $1,000 invested in 1998 in a broad market index, like the Russell 3000 Index, grew to nearly $6,400 over the following 25 years. However, if you were out of the market for the best week during that 25-year time period, your return would have been reduced by over 15%. Similarly, if you were out of the market for the best three months during that 25-year period, your return would have been reduced by nearly 30%.

Equity Drives Long-Term Returns

Most clients we work with at HTG are looking for a strategy to grow their assets so they can meet short and long-term goals – pay off debt, save for their first home, college, or retirement. Some are fortunate they have enough money to be philanthropic or grow their children’s inheritance. Regardless of your situation, your assets need to grow to achieve your goals.

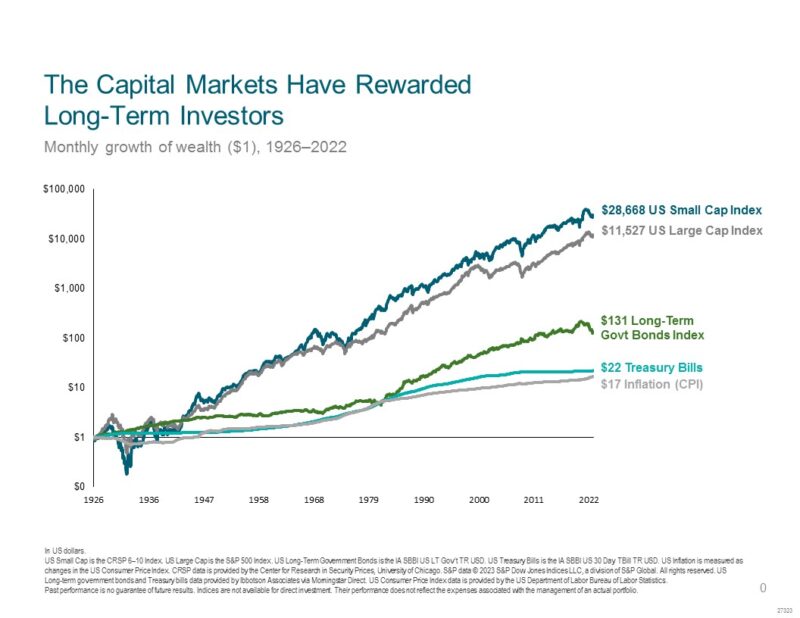

Even with money market funds yielding north of 5%, investing in equities (stocks) is necessary to achieve real (net of inflation) asset growth. As demonstrated in the chart above, also by Dimensional Fund Advisors, since the early 1900s, small and large cap equity indices have significantly outperformed long and short-term bond funds. This is not to say portfolios should be invested 100% in equities. Cash and high-quality short-term bonds play an important role in every investor’s portfolio – they help mute return volatility, provide a source of liquidity during prolonged market downturns, and are a safe haven for near-term spending needs (the next two years). However, equity exposure is the key driver of long-term returns. Also, keep in mind that a money market fund yielding 5% is indeed attractive, but rates will eventually return to a more normalized level of 2-3% as the economy returns to its natural rate of growth.

Finding the Right Asset Mix

Instead of trying to make tactical moves by moving in and out of cash, investors should decide on an asset allocation strategy they can stick with in up and down markets. Higher exposure to equities should result in higher returns but will also come with greater risk and portfolio volatility. Greater exposure to cash and fixed income will result in smaller returns but less volatility. What’s important is to find the right mix that will allow you to generate the returns necessary to meet your goals while also allowing you to sleep at night.

If you are worried about the market and are considering trading out of equities into cash, then you may not have the proper asset allocation. When you hold the appropriate level of cash and high-quality fixed income to fund your short-term cash needs (next five years), you will realize short-term stock market volatility is not a real risk, and you will be less likely to make tactical decisions that could jeopardize long-term returns.

If you have questions or wish to discuss your asset allocation, please reach out to your HTG advisor.