With inflation rising, many investors are wondering about ways to protect their portfolios. I Bonds (Series I Savings Bonds) have been in the news a lot of late, offering a risk free investment rate of 9.6% for bonds issued in May. TIPS (Treasury Inflation-Protected Securities) are another investment option that can be used to combat inflation. We will explore both of these options in this article.

What are I Bonds?

I Bonds are a savings bond offered by the U.S. Treasury that can only be purchased online directly by the investor (advisors cannot purchase or monitor the bonds on behalf of a client). The limit is $10,000 per person, per year when purchased electronically, although an additional $5,000 per year may be purchased in paper form with proceeds from a federal tax refund.

Key features of I Bonds are:

- The interest rate has two components, a fixed rate which is currently zero, and a semi-annual inflation component, currently 7.12% annualized, that is adjusted every six months in May and November. In May 2022, the rate is expected to move up to approximately 9.6% annualized. The inflation component is based upon changes in the Consumer Price Index for all Urban Consumers (CPI-U), non-seasonally adjusted.

- Interest is exempt from state and local tax. Most individuals defer paying federal tax on the interest until the bond matures or is cashed in.

- I Bonds are designed to be owned individually, not jointly and not in a retirement account. They can be owned by certain trusts.

- The bonds are issued electronically in $25 increments and the purchase amount is the face or par value.

- The bonds mature in 30 years, after which no interest accrues.

- You must hold the bonds for at least one year. If you cash the bond in before holding it for five years, you lose 90 days of interest.

- I Bonds can be used for education purposes provided one meets the income limitations.

I-bonds add the inflation adjustment rate to their principal value, while most other bonds pay a semi-annual cash interest payment. As an example, after one year, the principal on a $1,000 I-bond with a 6% rate will increase to $1,060. Assuming the inflation adjustment rate for the second year is 6%, the investor earns 6% on $1,060, not on $1,000. This compounding feature can lead to a higher yield on the bond over time.

The actual return on the I Bond will depend on the holding period and what happens to the inflation rate adjustments over time. If inflation levels drop, the yield on the I-bond will also drop but will never go below zero.

Investors have the administrative burden of keeping track of the I Bonds and cashing them in. Given the annual investment maximum of $10,000, some may feel it is not worth the hassle. On the other hand, buying a $10,000 bond annually for each family member may feel like a worthwhile investment to keep up with inflation. I Bonds do not lose value as interest rates rise and can’t go below zero if interest rates drop.

What are TIPS?

Like I Bonds, TIPS are issued by the U.S. Treasury. They can be purchased online at auction via the Treasury Direct website, or through a broker on the secondary market. It is convenient to buy a TIPS mutual fund where you are investing in a basket of TIPS.

Key features of TIPS are:

- TIPs are adjusted for inflation, with the interest rate fixed at the time of issue and the principal amount adjusted based on the CPI-U. The fixed interest rate on the 10-year TIPS note was .125% at the latest auction at the end of March.

- Interest payments for the fixed rate are made every six months in cash.

- The bonds are issued in $100 increments with the price and rate determined at the time of auction. TIPS are marketable and can be transacted at a discount or a premium.

- Maturities can be 5, 10 or 30 years.

- Interest is taxed annually, as is any increase in the principal value due to the inflation adjustment. Like I Bonds, interest is not taxed at the state and local level.

TIPS can be a worthwhile investment choice when inflation is running high since payments are adjusted when inflation changes. The values of longer maturity TIPS can be volatile, as interest rates move up or down.

It is preferable to hold TIPS in retirement accounts, in order to avoid having to pay tax on income you have not received in cash (the adjustment to principal).

While I Bonds and TIPS may be an option for a portion of your investment portfolio, research tells us that for most individuals, the best investment vehicle to protect against inflation is diversified equity market exposure held for the long term.

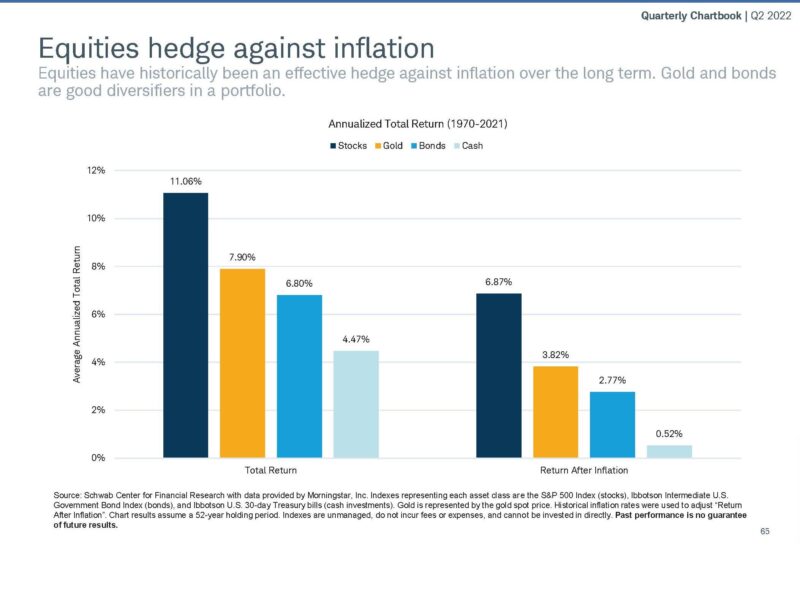

A graph from Schwab illustrates this point:

One can see on the right-hand side that the 6.87% after inflation return for equities over the period 1970-2021 was more than twice the 2.77% return from bonds. We are often distracted from this fundamental point by headlines and short-term market movements. Focusing on the long-term helps us tune out the noise and remember time-tested investing fundamentals.

Here are links to more information:

https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds.htm

https://www.treasurydirect.gov/indiv/planning/plan_education.htm

https://www.treasurydirect.gov/indiv/products/prod_tips_glance.htm