Inflation has a different impact on each of us. House hunters hate seeing prices rise while they are looking to buy. Homeowners enjoy hearing how much more houses in the neighborhood are selling for compared to what they paid. In the U.S., we haven’t seen significant inflation since the mid-2000s. Its return will create some winners and losers. However, there are strategies to mitigate potential losses.

Last summer, as many enjoyed a return to spending during a Covid case lull, we published our first article on inflation in decades: How to Manage Inflation Risk.

We outlined that inflation was on the rise due to increased demand and limited supply of both goods and labor. At the time, many economists and the Federal Reserve believed that inflation was transitory. The consensus was that workers would fill open positions, reversing the “The Great Resignation.” Logistics experts would untangle supply chains. Consumers would moderate their spending after satisfying two pandemic years of pent-up demand. Now, based on the latest data, it seems that a level of inflation above the Fed’s 2% target may last for a year or two.

This article strives to help us better understand inflation, who wins, who loses, and how to best protect our wealth.

Winners in inflationary times

- Homeowners planning to move to a less expensive house.

- Borrowers with fixed-rate loans: individuals, companies, Federal or State governments get to pay back their loans with less valuable money.

- Owners of assets that have appreciated more than inflation. Diversified portfolios of stocks have appreciated by 5% over the inflation rate since 1927, based on an analysis from the investment firm Dimensional Fund Advisors. Companies with oil and gas reserves have been winners this year after being losers at the start of the pandemic.

- Individuals with talents and experience in short supply. Employers have no choice but to pay more to maintain at least the inflation-adjusted salaries of the talent they need to retain.

Losers in inflationary times

Inflation impacts each of us in different ways. While we tend to focus on the most recent publication of the Consumer Price Index (“CPI”), it is important to remember that it is simply a weighted average of price changes of a collection of goods and services. Many New York City residents care more about Uber rates than new car prices. Education cost increases don’t impact anyone without kids to educate. The spending mix used in calculating the CPI is:

42% Housing

18% Transportation (cars, boats, planes, Ubers…)

14% Food and drink (home and away)

9% Medical care

5% Recreation

12% everything else (Education, clothes, internet, cell phones, streaming services…)

If your current spending is different from the above, your personal inflation rate will differ from what is reported. Even if your cost of living has not changed much this year, prices that we see frequently will influence us. For example, gas prices have been a particular shock since Russia’s invasion of Ukraine, and we see that daily as we drive by gas stations. Wheat prices are rising too and will either push up retail prices or reduce corporate profits.

What is even more important than your current spending mix are your long-term spending goals. If you plan on living in your home or buying a smaller one, you are less exposed to housing, particularly if you have no debt or a fixed-rate mortgage.

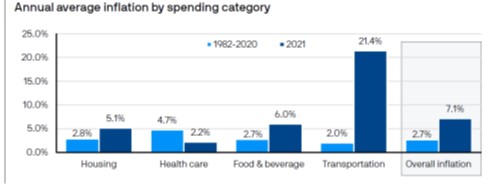

Below, thanks to analysts at JPMorgan, is a comparison of inflation rates over two time periods for a variety of spending categories:

Fighting inflation

Since inflation is caused by an imbalance of supply and demand, reducing it requires decreasing demand or increasing supply.

- Increasing supply of labor: There are more unfilled jobs than workers interested or qualified to fill them. To fill the need in the short term, employers are forced to pay higher wages. Over time, labor supply might be addressed through automation, increased productivity through training or immigration.

- Increasing supply of raw materials: Oil and gas prices have increased since Russia’s invasion of Ukraine. In the short term, North America and the Mid-East will strive to increase supply to moderate the price rise. In the long term, the shift away from carbon-based fuels will reduce demand. The only benefit of Russia’s invasion may be a greater effort to mitigate climate change.

- Increasing the cost of borrowing money: The Federal Reserve (“Fed”) will likely increase short-term interest rates to increase the cost of borrowing and thus slow economic growth.

- Decreasing the supply of money: The Fed is also planning to start reducing the supply of money later this year. This will be achieved by reversing the program called “Quantitative Easing” which increased money supply by printing money to buy bonds.

The challenge in fighting inflation is two-fold:

- There is always a delay between the action(s) taken on the supply – demand imbalance and the measurement of the change in prices. Often it can be many months until the calculated statistics show a change in inflation.

- Expectations matter. If manufacturers expect future costs of their raw materials to be higher, they will try to raise the prices of what they sell now. If workers expect their cost of living to continue to increase, they will seek higher salaries in advance.

How to protect your savings in the meantime

The current level of inflation is exceptionally high given that over the last twenty years, it has fluctuated between -0.4% and +3.8%. The Fed remains confident in their long-term 2% target, since there are multiple strategies to fight inflation and the commodity supply imbalances caused by the war in Ukraine will diminish over time. Even if your personal inflation rate is somewhere between 2 and 3%, it is still important to protect your financial assets from erosion of value over time.

Strategies can be divided between those focused on your expenditures and those that are investment portfolio related:

Consumption-based strategies:

- Consider reducing current demand for things in short supply or finding an acceptable substitute at a more reasonable price.

- Try to own the assets that are important to the enjoyment of your lifestyle. Buy a home if you are relatively confident about where you want to live for at least five years.

- If car lease rates remain attractive, consider leasing in the short term, then buying a car when supplies increase. This will limit your exposure to long-term lease expenses.

Investment focused strategies:

- To reduce inflation risk, you need to accept investment risk. Maintain an appropriate exposure to the publicly traded stock markets around the world. Individual companies may fail to grow revenues faster than costs; the same may be true for specific sectors but not for the global economy.

- As a component of your fixed-income allocation, consider U.S. Treasury Inflation Protected Securities (TIPS) or I Bonds. Both are linked to the Consumer Price Index so may not fully protect if your inflation rate is higher than the CPI. https://www.treasurydirect.gov/indiv/products/prod_tipsvsibonds.htm. Keep in mind that TIPS’ return only matches the Consumer Price Index (“CPI”), so they neither generate a return above the CPI nor do they protect if your inflation rate is higher than the CPI.

Other possible solutions include:

- Commodities: gold, oil, fresh water, not digital currency. These tend to be volatile and produce no income.

- Real estate: diversified properties where rents can be increased frequently to stay ahead of rising costs.

- Well-established collectibles: Rembrandts, not non-fungible tokens. These tend to be illiquid, incur significant costs to hold and sell.

None of us who remember the 1970s and early 1980s are happy about the return of inflation, but these strategies will help mitigate its impact.