The pandemic provides a recent opportunity for learning and reinforcing several time-tested investment principles. For young and experienced investors alike, it is worth pausing and reminding ourselves of these important best practices.

Diversification is your friend-it reduces risk and improves performance

During late February and the first three weeks of March 2020, investors witnessed a sharp decline in equities and other higher-risk asset classes. Even though high-quality bonds in a balanced portfolio were affected by price declines too, their fall was not nearly as severe, and bonds continued to cushion declines in equity values as they have in the past. Once the Federal Reserve put several safeguards into effect, liquidity issues and price declines started to resolve themselves, and the quickest rebound in U.S. equity markets on record ensued.

The importance of a long-term view

It is critical that an individual’s asset allocation matches their tolerance and capacity for risk. The optimal mix of equities and fixed income is such that the individual can weather the storm so to speak and stay invested through volatile periods. While the market swoon during the early stages of the pandemic was short in duration, we did not know that in advance. An investor should be thinking of the long term, three to five years or longer, for the equity portion of their portfolio.

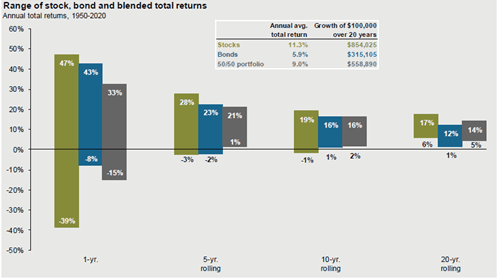

Looking back at history, the JPMorgan Chart below presents data on average annual returns from 1950 through 2020 using indexes as described. You can see the one-year returns for U.S. equities ranged from -39% to +47% and a balanced portfolio of half equities half bonds returned between -8% to +43%, quite a wide range of returns. Looking out over longer periods, the range of returns is narrower and there is a smoothing out effect. Over a ten-year period, the equity range of returns is -1% to +19% and the 50/50 portfolio is +1% to +16%. The likelihood of a positive return being much higher the longer the timeframe.

Source: JP Morgan Asset Management: Barclays, Bloomberg, FactSet, Federal Reserve, Robert Shiller, Strategas/Ibbotson, J.P. Morgan Asset Management. Returns shown are based on calendar year returns from 1950 to 2020. Stocks represent the S&P 500 Shiller Composite and Bonds represent Strategas/Ibbotson for periods from 1950 to 2010 and Bloomberg Barclays Aggregate thereafter. Growth of $100,000 is based on annual average total returns from 1950 to 2020. Guide to the Markets – U.S. Data are as of June 30, 2021.

Timing the markets is not a reliable investment strategy

Market prices reflect all the available public knowledge. Tail risks or events that cannot be foreseen, like a pandemic, produce jolts like we experienced in the first quarter of 2020. Looking back on this period, one can see that the timing and depth of a market decline or a surge cannot be reliably predicted.

Discipline is essential to overcome emotion

I can’t think of a single individual who was not experiencing at least one emotion, like fear for instance, during the pandemic and before vaccines were readily available. As professionals, we are trained to be aware of these emotions and exercise discipline so we can advise clients and distinguish between an individual that may have a change in circumstances driving their unease or an individual that needs help overcoming the emotion.

The chart below showing the growth of a dollar invested in equities over time is a reminder that equity markets have endured all sorts of crises yet have continued to rise over the long term when the investor has been disciplined, remaining invested.

Source: Dimensional Fund Advisors

To sum up, we strive to guide each client to an appropriate asset allocation well ahead of troubled times, so one is not tempted to sell equities at what turns out to be an inopportune time and will stay with their investment strategy as it evolves for the long-term.