Happy 529 Day!

As we celebrate this day dedicated to education savings, we’re reminded of the importance of investing in our children’s futures. Whether you’re a new parent filled with excitement for what lies ahead or a friend or family member seeking a meaningful gift for a child, we invite you to consider the gift of an education — by contributing to a 529 college savings plan.

What is a 529 Plan?

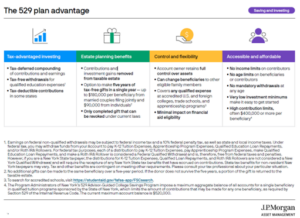

A 529 plan is a tax-advantaged investment account specifically designed for education savings. Contributions grow tax-free and withdrawals used for qualified education expenses are typically tax-free as well. This makes them a powerful tool for building a nest egg for college or other qualified educational pursuits.

Even small contributions made early and often can accumulate significantly by the time your child (or the lucky recipient) is ready for college. The power of compound interest can work wonders over time.

Common questions regarding 529 plans:

1. Who can open a 529 plan?

Anyone can open a 529 plan, regardless of income level. Parents, grandparents, other family members, and even friends can open an account for a designated beneficiary.

2. What expenses does a 529 plan cover?

Generally, 529 plans can be used for qualified education expenses, including tuition, fees, room and board, books, and sometimes even computers and software required for coursework.

3. Can 529 plan funds be used for expenses other than college?

While 529 plans are primarily designed for college expenses, they can also be used for certain K-12 tuition expenses. Additionally, some apprenticeship programs and student loan repayments may qualify. Each state 529 plan can differ on eligible non-college expenses, so it is important to review the eligibility of the state plan you are considering along with if there are any annual limits. For example, certain plans allow for K-12 tuition expenses, but they cap it at $10,000 annually.

4. What happens if the beneficiary doesn’t use all the funds in the 529 plan?

If the beneficiary does not use all the funds in the 529 plan, the account owner can change the beneficiary to another eligible family member, such as a sibling or a cousin, or even use the funds for their own education.

Alternatively, starting January 1, 2024, owners of 529 plans can roll over unused funds – up to a lifetime limit of $35,000 – into a Roth IRA account for the account beneficiary without tax or penalty, subject to certain limitations. The 529 account must have been open for at least 15 years, and the funds must be rolled over to a Roth IRA owned by the 529 account beneficiary. Only contributions that have been in the 529 for at least five years (plus any earnings on those contributions) can be converted.

5. Are there contribution limits for 529 plans?

Yes, each state sets its own contribution limits, which can be quite high, often exceeding $300,000 per beneficiary. However, contributions may be subject to gift tax rules if they exceed a certain amount per year.

6. Can you only invest in your state’s 529 plan?

No, you are not limited to your state’s plan. You can choose any state’s plan, and many states offer state tax benefits for residents who invest in their own state’s plan, but you can invest in any state’s plan regardless of where you live.

7. What are the tax benefits of contributing to a 529 Plan?

Contributing to a 529 Plan offers several tax benefits. Firstly, contributions and earnings grow tax-deferred. Secondly, withdrawals for qualified education expenses are typically tax-free. Lastly, some state plans offer state tax-deductible contributions, providing additional financial incentives for investing in a 529 Plan.

8. What happens if your child receives a scholarship?

If your child receives a scholarship, you can withdraw an equivalent amount from the 529 plan without incurring the usual 10% penalty for non-qualified withdrawals. However, you will still need to pay income tax on the earnings portion of the withdrawal.

9. Can you use a 529 plan to pay for international education expenses?

Generally, yes, you can use a 529 plan to pay for qualified education expenses at eligible institutions worldwide. However, it is essential to check the specific rules and regulations of your plan.

10. What happens if you need to withdraw funds from a 529 plan for non-qualified expenses?

If you withdraw funds from a 529 plan for non-qualified expenses, you will typically owe income tax on the earnings portion of the withdrawal, plus a 10% penalty. However, there are exceptions to the penalty in certain situations, such as the beneficiary’s death or disability.

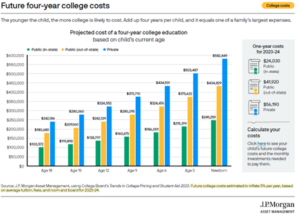

The cost of college is growing exponentially, as seen in the chart below. A child born today can expect to pay $583,000 for four years at a private college. Small contributions made early can have a big impact.

We hope this email helps to highlight the benefits of a 529 plan, which is a wonderful way to show your love and support for a child’s future. To learn more about 529 plans and explore different options, visit the College Savings Plans Network website.

Take Action Now!

- Estimate how much you will need for future college costs and set a savings goal for contributions. A college cost calculator can help!

- Ask if your employer offers any payroll deduction options to fund a 529 plan.

- Set up automatic recurring contributions from your bank account, if possible, to make depositing easy.