Planning for the future, particularly decades ahead, can be challenging when there are more pressing items vying for your time and attention.

While you are in your 20’s and 30s, retirement can seem a distant and elusive goal – not something high on your list of priorities. While that is true, it is important to capitalize on the time horizon you have now – which you will never be able to get back – to set yourself up for success down the road.

Taking small, consistent steps early can pay off later.

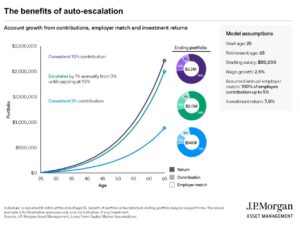

The below chart illustrates three examples of 401k contributions and the long-term impact savings patterns had on the participants’ retirement balances:

- The saver in blue consistently contributes 3% per year.

- The saver in purple consistently contributes 10% per year.

- The saver in green uses an auto-escalation approach, whereby the contribution begins at 3% annually and increases 1% per year until capping at 10%.

Increasing contributions each year can be an effective way to save more for retirement. By using the auto escalation feature, the saver in green ends up not far behind the saver who contributes 10% consistently. This shows the power and value of escalating contributions each year!

Take Action Now!

- Get a raise or bonus? Increase your 401(k) contributions in conjunction with this increased income.

- Setup an annual reminder to review your retirement contributions (IRA, 401(k), etc.) and progress towards retirement to evaluate if you can increase contributions.

- If your company provides a 401(k) match, make sure you are contributing at least this amount to receive it. It’s free money!

- If you are thinking about leaving your job, review your 401(k) vesting schedule to evaluate if you are fully vested. You could lose your company’s matching contributions and may want to weigh the timing of your transition to not leave money on the table.