Any investor who regularly watches their stock portfolio has seen swings in value – both up and down—that elicit a range of emotions from excitement to anxiety. The old adage, “keep calm and carry on” can be difficult to adhere to, especially when reading recent financial headlines.

The stock market is an information-processing machine in which the knowledge and expectations of investors are quickly incorporated into current prices. Millions of participants buy and sell securities around the world. The new information buyers and sellers bring to the markets helps set prices—and with each bit of new information, prices adjust accordingly.

Depending on what is happening around the world – economic changes, company earnings, geo-political conflicts – there can be wide swings in the market as it absorbs this information. So, while there might be some short-term bumps in the road for investors, things look brighter over longer periods of time.

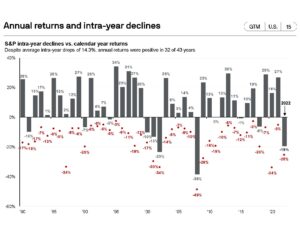

The JP Morgan chart below illustrates that since 1980 there has been an intra-year stock market decline (red dots) at some point during each year. However, this did not necessarily result in a negative return for the calendar year (gray bars). In addition, positive annual returns far outweigh the negative– despite down years about a quarter of the time, the average annual return in S&P 500 Index* was 8.7% (1980-2022).

The performance of stock markets can be wildly different from day to day and year to year. While volatility can be uncomfortable, it’s normal.

When investing in the market, you must accept some level of risk to reap the reward. Aim to create an investment portfolio you can stick with no matter the market and don’t let short-term swings derail your long-term plan.

Take Action Now!

- Keep enough money in less-volatile assets to meet your short-term needs (including an emergency fund of 3-6 months of living expenses).

- When investing in the stock market, have a long-term focus.

- Evaluate your current asset allocation (mix of stocks, bonds and cash). Is it appropriate for your time horizon and risk tolerance?

- Block out the noise and don’t check your accounts daily which can provoke anxiety. Instead, review on a monthly/quarterly basis.

- Find more insight on volatility here.