Many investors seek a “secret ingredient” for success, trying to identify the next big company or asset class. But are average investors really privy to information that others don’t have to select winners? And have a crystal ball to predict the future market and economic conditions? The evidence suggests not.

Over the last 20 years, the average investor earned an average annualized rate of return of 2.9% (compared to the S&P500, which earned 7.5%)1. And even the professionals don’t get it right all the time.

So, what is the real secret ingredient to successful investing? Diversification.

It’s impossible to predict the winners and losers for the year, which is why diversification is key to capturing a slice of the winnings.

The COVID-19 pandemic in 2020 provides a perfect example. That year, the US equity market tumbled precipitously in March to a low of -34% due to the world coming to a screeching halt. Could anyone have predicted that by the end of the year, the US market would have ended up +16%?2

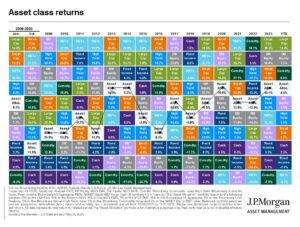

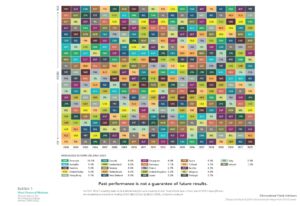

The slides below show different asset classes3 or geographies4 in various colored boxes, along with their annualized return over a 15—or 20-year period. This illustrates that no one color—country or asset class—holds the top spot, and the return patterns vary greatly from year to year.

Click on slides below to view/enlarge

Since no one has a crystal ball to predict the next winner, by spreading your investments strategically over a wide array of asset classes and geographic areas, you are able to cast a wide net to capture the upside in the market—wherever it may lie. Not to mention, it smooths the ride and enhances stability in your portfolio, while safeguarding against market volatility.

Take Action Now!

- Review your investment portfolio and assess if you own a range of asset classes, market capitalization, and geographies. Proper diversification can be most efficiently obtained by investing in mutual funds and ETF’s.

- Make sure to review your portfolio at least once a year. Due to market ups and downs, you can become overweight or underweight in various asset classes and may need to rebalance.

- Single stock positions like RSU stock or other holdings can create concentration risk, so it’s important to diversify your remaining portfolio to account and counterbalance this large concentration.

1 JPMorgan, Guide to the Markets, “Diversification and the average investor”, page 63, March 31, 2022.

2 JPMorgan, Guide to the Markets, “Annual returns and intra-year declines”, page 16, May 31, 2024

3 JPMorgan, Guide to the Markets, “Asset class returns”, page 60, March 31, 2022.

4 “Which Country Will Outperform? Here’s Why It Shouldn’t Matter.” Dimensional Fund Advisors Perspectives, Dimensional Fund Advisors, 8 Dec. 2023, dimensional.com.