In today’s world, we have easy access to technology which allows us to track our investment portfolio frequently. However, as an investor, patience and time can be your greatest allies.

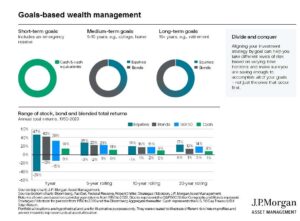

The JPMorgan bar graph below shows returns for stocks, bonds, cash, and a mixed portfolio over various periods. These investments have different volatility, which can be thought of as the magnitude with which they go up and down. Note that stocks, as represented by the S&P 500, are the most volatile, and from 1960- 2023 were up as much as 47% and down as much as 39% in any one year.

However, the longer the period, the narrower the range of returns. For example, the worst 10-year period for stocks was -1%, and the worst 20-year period, +5%.

Investors need to accept short-term volatility as a part of investing. It’s important not to overreact during tough times but instead view things with a long-term perspective. Time can smooth the ride and it pays to be patient!

But what if you have a short time horizon to invest? Say, for example, you want to buy a home in the next year, how should you invest your down payment until it’s time to close on the house? In that case, you need to align your investment strategy with your short-term goal and invest in something less volatile than stocks such as cash or cash equivalents. If you were to invest 100% in equities, you may experience significant swings, as shown in the chart. Imagine if you had to sell at the bottom (-39%) to pay for your new home! It’s important to marry the time horizon of your cash needs with your investment strategy.

Take Action Now!

- Review your short- to long-term goals and evaluate the allocations of these buckets of money to see if they are appropriate.

- Set a reminder to review this at least annually to reevaluate your goals and investment strategy. If you work with an advisor, make sure they are aware of any updates to your goals.

- Try not to check your portfolio every day or week which can illicit anxiety by focusing on short-term volatility of returns.