Are you a millennial or young professional who has made great strides in growing your career in your twenties and thirties? Have you now enjoyed the fruits of your labor with more income and started to think about other priorities on the horizon, like buying a home or having kids? Is your financial situation now more complex? It seems crazy to think that the adage is true: “more money, more problems.”

Young professionals have a long time horizon to work and grow their assets, but they need to be poised to make strategic decisions – even small, incremental ones – that can have a meaningful impact in the long run on their portfolios. But where do you start? And what questions do you need to ask?

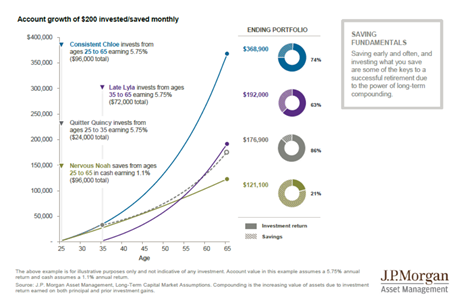

The Importance of Starting Early

The J. P. Morgan Asset Management chart below illustrates the benefits of saving and investing early and often by comparing a few different scenarios. Chloe’s account ends with the highest portfolio value due to consistent savings from age 25 to 65 and the benefit of compounded returns year over year. By contrast, Lyla started saving and investing ten years later, Quincy only saved and invested for a ten-year period, and Noah did a good job saving but not investing (kept in cash). All their portfolios are sizably smaller than Chloe’s portfolio due to inconsistent patterns in saving and not taking part in the market over a long time horizon. This highlights that even small missteps can have a dramatic impact down the road on your portfolio.

The Financial Plan Blueprint

Finances can be an overwhelming and multi-layered matter to tackle, especially as young professionals are focused on growing their family, career, and home. Finance can entail digesting a lot of information, staying apprised regularly of the markets and new regulations, and reviewing tradeoffs to make well-informed decisions.

This is where a financial advisor can come in. A financial advisor can act as the Architect and Project Manager for your finances – they learn about your ambitions and goals in order to formulate a well-designed blueprint – or financial plan – to meet your needs. A financial plan takes everything we know about your financial circumstances today and overlays information and assumptions about the future. This will provide a long-term vision of your finances and the building blocks to help achieve your goals – buy a vacation home, pay for your kids’ college, save enough for retirement to sustain your lifestyle, and give to charity. Your financial plan will help quantify the decisions you are making today – taking that new job or buying a stretch home – and the impact this will have on your financial picture in 10, 20, 30 years.

Implementing Your Blueprint

While it is great to have a detailed financial plan, it’s the implementation of the plan that will get you to the finish line. This can be a weekly, monthly, or even daily task to ensure you are on the right path. It can be challenging to track your financial plan regularly and stay on course. Engaging with an advisor can help you stay on track, and an advisor can be a sounding board during life events that come up, both expected and unexpected (i.e., job transition, new baby). Deciding how best to adapt or pivot can help ensure you will still reach your goals – and take some of the stress off your plate.

Review our financial blueprint or checklist to help get you started. It will help you begin to think of all the financial building blocks at play to get you on a path to success and will show the various elements financial advisors at HTG discuss with their clients regularly to ensure they stay on track to meet their goals.